Binance, globally recognized as the world’s largest cryptocurrency exchange, has recently faced a series of significant legal challenges. After being under scrutiny by the U.S. Department of Justice (DoJ) since 2021, it now finds itself in troubled waters with serious allegations of violating the Bank Secrecy Act. This has led to an unprecedented fine and a change in management.

Dancing with the Devil: Legal Challenges

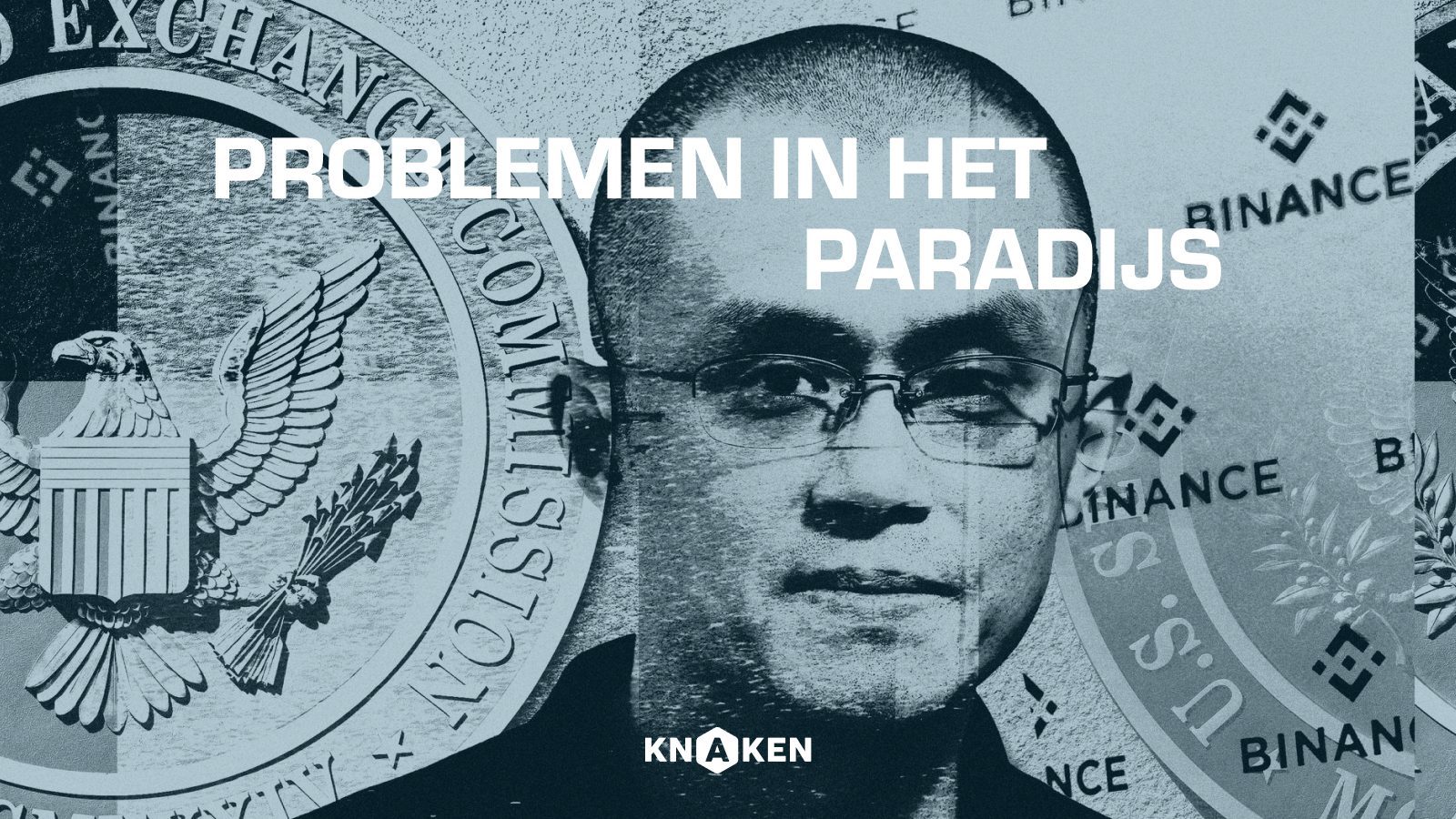

In recent years, U.S. authorities have intensified their investigation into Binance’s activities. The DoJ has charged that Binance, led by CEO Changpeng Zhao (CZ), failed to implement an effective anti-money laundering program, a serious violation of the Bank Secrecy Act. Additionally, Binance is accused of facilitating transactions related to unsavory activities like child sex abuse, drug trafficking, and terrorism financing.

Unraveling: Settlement and Resignation

In response, Binance has negotiated a settlement involving a hefty fine of $4.3 billion to resolve the criminal charges. To prevent further escalation, CZ has stepped back, agreeing to resign from his position and plead guilty to the criminal charges of money laundering. According to the details of the settlement, Binance will pay $1.81 billion in costs, forfeit $2.5 billion, and CZ will personally contribute approximately $50 million.

The Path Forward: Future of Binance

Despite these significant setbacks, Binance remains financially healthy, with seemingly ample assets on its balance sheet to weather this storm. The company is also required to appoint an independent monitor and regularly send compliance reports to the U.S. government, adding an extra layer of oversight to its operations. For Binance, these setbacks could serve as an opportunity to better comply with regulatory standards, shedding its rebel image for a more compliant, globally appealing market presence. However, should it bear the burden of this massive fine, it could also lead to operational changes that may impact transaction volumes and, more importantly, customer trust.

Regulatory Hurdles: A New Normal for Crypto Exchanges?

The legal scrutiny of Binance highlights the regulatory challenges the broader crypto space has been grappling with, particularly in jurisdictions like the U.S. These events have compelled Binance, along with its American counterparts, to alter their terms of service, preventing users from directly withdrawing dollars from the platform, except via stablecoins. The hurdles and their aftermath underscore the urgent need for regulatory clarity in the global cryptocurrency market, a concern that extends beyond Binance.

Deciphering the Implications: What Does This Mean for Crypto?

Such turbulence within a leading exchange naturally raises the question – what does this mean for cryptocurrencies in general? To begin with, this development underscores the regulatory pressure that the cryptocurrency industry globally is increasingly facing. Stricter compliance requirements may become the norm for crypto businesses. While the initial response of the crypto markets has not been dramatic, the long-term implications for cryptocurrency prices and market sentiment remain to be seen. How users perceive these developments and how other offshore exchanges respond will determine the way forward. All eyes are now on the crypto industry as it navigates these trying times, potentially laying the groundwork for a new era of compliance and transparency.

Solid Ground: Knaken’s Position

Knaken, licensed by the Dutch central bank (DNB), remains far removed from similar legal troubles experienced by some competitors. Our choice to adapt to regulatory standards fosters a secure environment for our users. We believe in the role of ‘good players’ within the crypto space instead of pushing regulatory boundaries, maintaining the trust of our users and ensuring market stability.

A Reliable Partner: The Assurance of Knaken

Knaken is committed to presenting an ethical, audited, and regulated approach to crypto trading, providing safety for our users. We steer clear of the dangers that ‘crypto cowboys’ may face, demonstrating our commitment to maintaining a robust and reliable platform for our customers. Our approach builds trust and promotes a transparent crypto market.

Knaken Cryptohandel B.V. has applied for a MiCA license from the Netherlands Authority for the Financial Markets (AFM). This application is currently being assessed by the AFM.

Investing in crypto-related products involves significant risks.